The Complete Guide to Accounting Software for Small and Large Businesses

Accounting software is a digital tool that helps businesses manage their financial transactions, track expenses, generate reports, and ensure compliance with tax laws. It automates complex accounting tasks such as bookkeeping, invoicing, payroll, and financial reporting, making it essential for both small businesses and large enterprises.

Why Accounting Software Matters

Managing finances manually can lead to errors, wasted time, and compliance risks. Accounting software simplifies this process by:

- Automating data entry and calculations

- Organizing financial records

- Generating accurate reports

- Streamlining tax filing

- Improving cash flow visibility

Whether you're a freelancer, startup, or large corporation, the right software can help you make smarter financial decisions.

Key Features of Accounting Software

✅ Invoicing and Billing

Create professional invoices, track payments, and send reminders automatically.

✅ Expense Tracking

Record and categorize expenses to monitor spending and reduce waste.

✅ Bank Reconciliation

Connect with your bank to match transactions and avoid discrepancies.

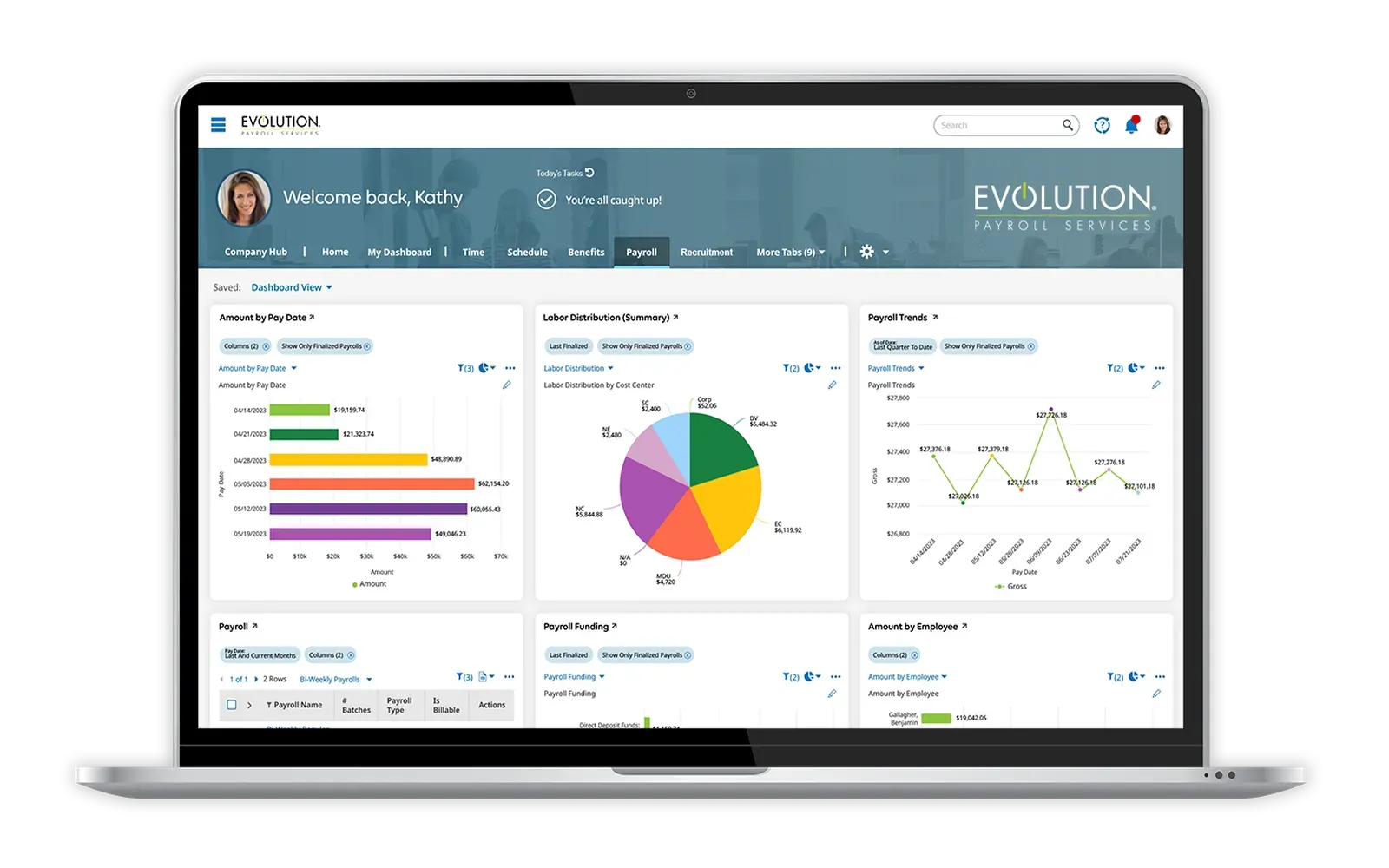

✅ Payroll Integration

Process salaries, withhold taxes, and issue pay slips directly within the platform.

✅ Tax Management

Calculate taxes automatically and generate reports for tax filing.

✅ Financial Reporting

Generate income statements, balance sheets, cash flow reports, and more.

✅ Multi-Currency Support

Ideal for businesses dealing with international clients.

✅ Inventory Management

Track stock levels, reorder points, and costs of goods sold (available in some systems).

Benefits of Using Accounting Software

- 🕒 Saves Time: Automates repetitive tasks like data entry, bank reconciliation, and reporting.

- ✅ Improves Accuracy: Reduces human error and ensures precise financial records.

- 📊 Real-Time Insights: Monitor financial health and make informed decisions.

- 💰 Cost-Effective: Minimizes the need for full-time accountants or bookkeepers.

- 📄 Tax-Ready Financials: Helps you stay organized and compliant during tax season.

- 🔒 Secure Data Storage: Protects sensitive information with encryption and backups.

Types of Accounting Software

1. Cloud-Based Accounting Software

Accessible online from any device. Ideal for remote teams and real-time collaboration.

2. Desktop Accounting Software

Installed locally on a computer. Offers full control but lacks remote accessibility.

3. Enterprise Accounting Software (ERP)

Advanced systems for large businesses that integrate accounting with HR, inventory, and more.

4. Industry-Specific Solutions

Tailored for sectors like construction, nonprofits, retail, or hospitality.

Popular Accounting Software Providers

| Software | Best For | Key Features |

|---|---|---|

| QuickBooks | Small to mid-sized businesses | Invoicing, bank sync, payroll, tax tools |

| Xero | Freelancers & global teams | Cloud-based, multi-currency, user-friendly |

| FreshBooks | Service-based businesses | Time tracking, client billing, reports |

| Zoho Books | Budget-conscious users | Inventory, automation, client portal |

| Sage Accounting | Growing businesses | Robust reporting, scalability, integrations |

How to Choose the Right Accounting Software

- Determine Your Business Size and Needs Are you a solo entrepreneur or managing multiple departments? Look for scalability.

- Check for Integration Ensure the software works with your payroll system, bank, or CRM.

- Consider Ease of Use Opt for an intuitive interface, especially if you don’t have an accounting background.

- Review Pricing Plans Choose a plan that fits your budget and includes essential features.

- Verify Compliance Capabilities Check for support in your local tax regulations and reporting formats.

- Customer Support Look for 24/7 support or access to accounting professionals.

Setting Up Accounting Software

- Input Company Information: Business name, address, tax ID, fiscal year.

- Connect Bank Accounts: Automatically import and categorize transactions.

- Add Customers and Vendors: For tracking payments and invoices.

- Set Up Chart of Accounts: Organize financial data into income, expenses, assets, etc.

- Enter Opening Balances: For a smooth transition from old systems.

Conclusion: Accounting Software Is a Smart Business Investment

From streamlining daily operations to improving financial accuracy and compliance, accounting software is an invaluable tool for businesses of all sizes. By automating key processes and offering real-time insights, it empowers business owners to stay organized, make informed decisions, and grow with confidence.

Whether you’re just getting started or scaling up, the right accounting software can be your financial backbone.

Frequently Asked Questions (FAQs)

Q1: Can I use accounting software without accounting knowledge?

A: Yes—most platforms are designed for non-accountants with intuitive dashboards and built-in guidance.

Q2: Is cloud accounting software safe?

A: Reputable providers use encryption, firewalls, and backups to secure your financial data.

Q3: Can accounting software replace an accountant?

A: It simplifies many tasks, but a professional accountant can still help with strategy, compliance, and audits.

Explore

A Complete Guide to Payroll Software for Modern Businesses

Finding the Best Online MBA in Accounting and Finance

A Complete Guide to Home Renovation for a Modern and Functional Space

A Complete Guide to Physical Therapy for Pain Relief and Mobility Recovery

Finding the Perfect Fit: Best Online Accounting Degree Programs 2024

The Complete Guide to Carpet Cleaning Services for a Healthier Home

Empower Your Career with a Flexible Online Software Engineering Degree

Top Online Master of Social Work (MSW) Programs and Degrees in 2024